By David Clayton

Reports in the media last week indicated that Berkshire Hathaway’s (BRK.A, BRK.B) warrants in Goldman Sachs (GS) now have a paper gain of more than $2 billion.

The difference between the strike price and the share value translates into a $2.19 billion paper profit for Berkshire.

But this approach is wrong. Depending on how it’s calculated, Berkshire’s paper profit at the close July 23 was at least $3.1 billion, and could be more than $6 billion.

The recent article fails in its analysis because the author simply multiplied the number of warrants Berkshire received by the difference between the current stock price and the strike price. This approach provides just part of the story, which is the value of the warrants if they were exercised today.

But it doesn’t reflect the current market value of the warrants, nor does it recognize the value of the warrants when the deal with Goldman Sachs was struck. It also doesn’t include any discussion of the change in value of the preferred shares Berkshire acquired.

On September 23, Berkshire announced the terms of a $5 billion investment in GS preferred equity and warrants. In the eight weeks after the deal was announced, GS common stock was down nearly 60%.

Amid the market chaos, Buffett critics loudly decried the GS and General Electric (GE) investments as mistakes. “So far,” Simon Maierhofer of ETFguide.com wrote on November 18, “Buffett has lost over $2 billion on the Goldman deal.”

This article, like the ones recently, incorrectly valued the investment, and dramatically so. This article failed because it didn’t recognize how good a deal this was for Berkshire from the start.

The Simple Valuation

The easiest way to place a value on the investment is to imagine that it was cashed out today. Here are the terms: for Berkshire’s $5 billion investment:

- Berkshire received perpetual cumulative preferred stock paying a $500 million annual dividend

- Berkshire received warrants to buy 43.48 million GS common shares at $115, exercisable at any time before October 2013

- GS can redeem the preferred stock at any time, and will pay Berkshire $500 million when it does so

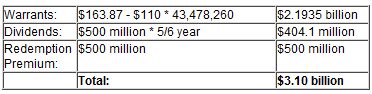

If at the close July 23, GS redeemed Berkshire’s preferred shares, and if Berkshire had exercised its warrants, here’s where the accounting would have stood:

This, the most conservative estimate possible, says Berkshire’s return on this investment has been 62% in 10 months.

Of course, Goldman hasn’t redeemed the shares and Berkshire’s not about to cash out the warrants. And it’s necessary to dig deeper to really understand what Berkshire’s return on the preferreds has been.

Analyzing the Investment More Rigorously

The investment has two parts, preferred shares and warrants, and it’s necessary to analyze each part independently to get a full picture of how good or bad the investment is.

Valuing the Warrants

Many authors writing about the Berkshire investment fail to describe the importance of the warrants, all too often indicating that they are somehow less important than the preferred shares.

However, the warrants have the potential to be enormously profitable, and were integral to the deal; they allow Berkshire to benefit from common stock appreciation, while the preferred shares don’t.

"The preferred pays us the dividend, " Warren Buffett said recently on Fox Business. "The warrants are going to make us the money."

The potential to share in gains made this part of the investment very valuable on September 23.

The warrants are basically American-style call options, exercisable at any time before October 2013. While there is no standard method for valuing American-style call options, the Black-Scholes option pricing model is the industry standard for valuing European-style options. European-style options can be exercised only at expiration; since American-style options have greater flexibility in execution, they are more valuable.

The inputs to Black-Scholes and my methods for determining their values:

- The value of the underlying investment – the market price of GS

- Strike price of the option (Strike) – $115/share

- Time to expiration (Time) – at the outset, this was 5 years

- The current risk-free interest rate (IntR) – generally that of Treasury securities maturing at the same time the option expires; the value is based on the Treasury’s daily yield curve tables

- The dividend yield over the life of the option (Yield) – this was estimated using the trailing 12 months of dividends divided by the market price of GS common

- Volatility (Vol) – ideally, this will be the volatility of the underlying option over the option’s life; obviously, this can only be estimated. Since time-to-expiration of the warrants was 5 years, I used a volatility calculation based on the previous 5 years of daily price data. In the 10 months since the deal was struck, GS stock’s volatility has shot up; however, since I believe this to be a short-term disruption in the market, I have elected to use the September 23 volatility figure for all calculations. The result is that Black-Scholes values are lower than they would have been with a higher volatility figure.

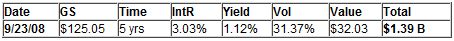

Here’s what Black-Scholes says the warrants were worth at the close September 23:

Multiplying this by the 43.478 million warrants Berkshire received, the initial value of the warrants was $1.39 billion.

Valuing the Preferred Shares

We will never know what value the market would place on Berkshire’s preferred GS shares, since they will never be traded. However, we can make reasonable estimates based on the market prices of similar securities.

If there were exchange-traded cumulative preferred shares of GS, this would be a simple matter of assigning the yield of those shares to the Berkshire investment and backing out a market value (divide the $500 million dividend by the yield to return the market value).

However, all of the exchange-traded GS preferred series are non-cumulative. So estimating the value of Berkshire’s investment is a bit more complicated.

Preferred share values are primarily determined by two factors: market interest rates and risk, risk being the probability that the dividend won’t continue to be paid. Because Berkshire’s preferred shares are cumulative, the risk that the dividend won’t be paid is much different than for its non-cumulative preferreds; GS must pay the cumulative preferred’s dividend unless it goes bankrupt.

Therefore, the risk premium demanded by investors in cumulative preferreds is lower than that demanded by non-cumulative preferred investors, and yields are lower.

For example, there are both cumulative and non-cumulative exchange-traded preferred shares of JP Morgan (JPM). The non-cumulative always yields more than the cumulative; between September 5 and September 23, the non-cumulative averaged a 1.0% higher yield than the cumulative.

On March 6, at the market bottom, this spread had increased to 4.4%, reflecting the perception that JPM might at some point not pay the non-cumulative preferred dividend. Since April 1, this spread has ranged between 1.1% and 1.8%.

Another factor affecting the value of the preferred shares is their redemption rules. If the company can redeem the shares and end the investor’s revenue stream, the yield demanded will be slightly higher.

I don’t have a good sense of how large this impact is, and have increased my estimated market yield for the Berkshire shares by 0.2% across the board to account for this effect.

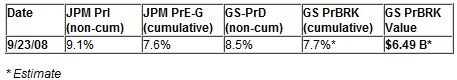

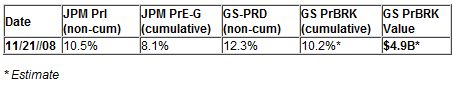

The table below shows September 23 data used to estimate the initial value of Berkshire’s preferred equity investment in Goldman Sachs, where:

- JPM PrI – J-series non-cumulative preferred

- JPM PrE-G – average of three series of cumulative preferred

- GS-PrD – the most liquid of GS non-cumulative preferred series

- GS-PrBRK – estimated yield if GS cumulative preferreds were traded

Dividing the $500 million annual dividend by the estimated yield gives the estimated value: $6.49 billion.

When the Deal Was Made

So, the market value of the $5 billion Berkshire Hathaway investment in Goldman Sachs on September 23 was $7.89 billion, or 58% more than the deal’s price.

This figure is so outsized that it begs for debunking. I invite critiques of method. Perhaps I got something wrong. But even if my calculations end up discredited, there are basic facts indicating that Berkshire significantly underpaid:

- The warrants have some value; the mere fact that they’re not being exercised demonstrates this. "Every instinct in my body," Buffett said, "tells me that we will want to hold those warrants until they're very close to their expiration date." And while Buffett has stated that Black-Scholes increasingly overstates the value of options as the time-to-expiration increases, 5 years isn’t so long that the calculation would be geometrically wrong. I’ve also used a somewhat conservative volatility figure.

- The yield on the preferred shares was far higher than what the market would have demanded. Remove the value of the warrants from the total investment to determine the yield on the preferreds: $5 billion less $1.39 billion is $3.61 billion. The $500 million dividend indicates that the yield on the equity investment was 13.9%. Let’s be very conservative and suppose the warrants were only worth $500 million when the deal was struck (preposterous, since they would have generated a $437 million gain if exercised that day). That would place the cost of the $500 million annual dividend at $4.5 billion, for an 11.1% yield. That’s 2.6% more than what GS non-cumulative preferreds – riskier investments – were yielding on the NYSE.

At the Bottom – November 20

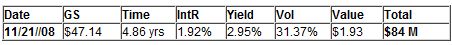

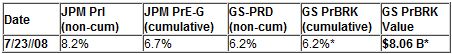

On November 21, shares of GS hit their bottom of 47.14. At this moment, Black-Scholes says that the Berkshire warrants were worth $84 million, for a loss of $1.309 billion since the deal was announced:

The Berkshire preferred yield likely would have peaked at about 10.2%, based on the JPM data and the GS non-cumulative peak yield of 12.3%; this corresponds to a market value of about $5 billion.

So Simon Maierhofer of ETFguide.com was right - Berkshire had lost $2.904 billion. What he didn’t say is that at this point, at the very bottom, when GS common had lost 62% of its value, Berkshire’s investment was worth about $5.035 billion (including accrued dividends), pretty close to what it originally invested.

And had Goldman redeemed the shares then, Berkshire would have collected the $500 redemption premium.

Today

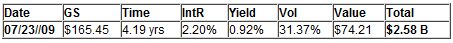

On July 23, GS closed at $165.45, up $40 in the 10 months since the deal was made. GS preferred shares are up close to 40%. And Berkshire’s investment has performed similarly. The warrants:

And the preferred shares:

Add in $404 million of accrued and collected dividends, and Berkshire’s investment is now worth $11.05 billion, not including the $500 million redemption premium GS must pay when it redeems the preferred shares.

The Bottom Line

When the deal was struck, Buffett purchased $7.89 billion of securities at a 37% discount. Ten months later, the investment had grown another 40%; the total return is more than 120% in ten months. Even using the most conservative valuation method, Berkshire’s return is $3.1 billion, or 62%.

During this period, gold has returned 5.7%. The S&P 500 lost 15.9%.

Suppose GS redeems the preferred for $5 billion on October 1. Berkshire will have received $500 million in dividends, or 13.9% of the investment less the initial value of the warrants. Further suppose that GS common stock appreciates by 8.6% per year through October 1, 2013, the warrants’ expiration date, regaining its 2007 high of 233 on that date. Berkshire would buy $10.13 billion worth of stock for $5 billion. That’s an annual return of 36.5%.

Naturally, the return on the warrants is tied to that of GS common. If the stock is stagnant at 165, the options will pay just $2.19 billion, or 11.4% per year. And if Goldman stock declines, the warrants would be worth less.

But if GS grows at 11.3%, as it did for the 7 year period starting 1/1/2000, Berkshire’s gain on the warrants would be $6.19 billion, for a 42.8% annual gain.

When properly valued, this investment certainly looks like it will go down in history as one of Warren Buffett’s greatest.

No comments:

Post a Comment